According to research, 68% of small businesses are now using less cash and fewer paper checks.

Furthermore, 58% of businesses that do B2B operations are likely to switch most of their payments from checks to electronic payments soon.

This shift means that the majority of customers now expect payments to be quick and easy.

So, if you’re a personal trainer and you’re still using old methods to accept payments, you might be falling behind your competitors.

Implementing all-in-one advanced systems like Virtuagym pay can help you maximize your overall earning potential.

In this article, we will show you how using Virtuagym Pay can help you maximize personal trainer revenue.

1. Automated Payment Processing

Virtuagym Pay automates the entire payment process, allowing you to efficiently manage both debit and credit transactions.

This automation reduces the time spent on administrative tasks like billing and collecting payments, allowing you more time to focus on client sessions and acquiring new clients.

Here’s how this feature of Virtuagym Pay can help personal trainers streamline their operations and boost their financial performance.

Efficiency in Revenue Collection

Automated payment processing reduces the time and effort needed to manage transactions manually.

For personal trainers, this means that payments for sessions are processed immediately and automatically after the service is rendered, ensuring that there is no delay in revenue collection.

Additionally, the quick and reliable payment process can attract more clients, who value efficiency and convenience.

Reduction of Missed or Late Payments

One of the common challenges in the personal training industry is managing overdue payments. Clients may forget to bring cash, or manual payment processes might delay transactions.

Automation ensures that payments are processed on time, reducing the number of missed or late payments.

Moreover, the reduced time dealing with financial transactions allows trainers to focus on programs that can make more money, like group classes or extended session packs.

Subscription and Recurring Payment Management

Many personal trainers offer packages or subscriptions to their clients, which can include several sessions per month or other recurring services.

Automated payment processing is particularly advantageous here, as it allows for the automatic handling of recurring payments on a set schedule.

This not only assures continuous revenue without the need to remind clients manually but also simplifies budget forecasting and financial planning for the trainer.

Increased Client Retention

The ease and convenience of automated payments can enhance client satisfaction, as clients appreciate a seamless and hassle-free transaction process.

This positive experience can be a deciding factor in client retention, encouraging them to continue their training sessions without interruptions related to payment issues.

Offering efficient personal training services with automated payments enhances the perceived professionalism and reliability of these services.

Upselling and Cross-Selling Opportunities

With the time saved from manually handling transactions, personal trainers can focus more on upselling or cross-selling additional services such as nutrition planning, online coaching sessions, or special fitness workshops.

This setup not only streamlines revenue collection but also creates opportunities for generating passive income through automated recurring payments for long-term programs.

Real-Time Financial Reporting

Automated payment systems typically come with real-time reporting features, providing personal trainers with instant access to their financial data.

This visibility allows trainers to monitor their earnings, adjust their pricing strategies, and identify the most profitable services or packages.

Real-time data helps in making informed decisions that can directly impact revenue growth.

2. Centralized Financial Management

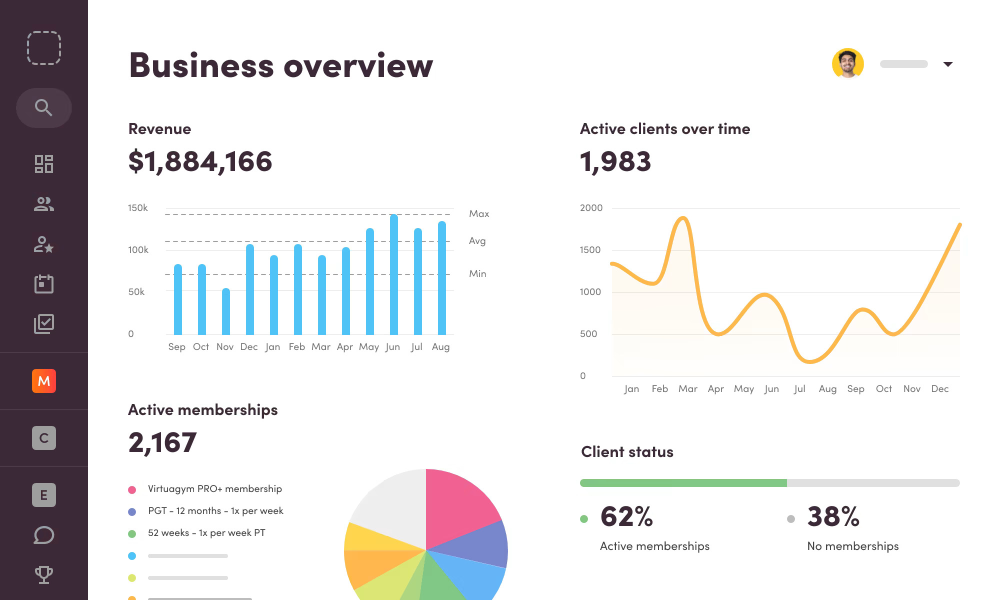

With Virtuagym Pay, you can centralize your financial operations in one platform.

This integration offers a clear view of pending payments and total revenue, which aids in better financial planning and budget management.

Accurate and timely financial insights help you make informed decisions about your business growth strategies.

Here’s a deeper look at how this functionality supports personal trainers in optimizing their financial performance and business growth:

Unified Overview of Financials

Having a centralized financial management system allows personal trainers to see all their financial transactions, balances, and metrics in one place.

This comprehensive view eliminates the need to switch between different applications or manually compile data from various sources, saving time and reducing the risk of errors.

It enables trainers to quickly assess their financial health, monitor cash flow, and make prompt decisions based on accurate financial data.

Efficient Financial Tracking and Analysis

Centralization facilitates better tracking of income streams and expenses.

Personal trainers can easily categorize their revenues from different services such as one-on-one sessions, or group fitness classes.

Understanding these financial nuances is essential for fitness professionals aiming to optimize their income.

Additionally, tracking expenses in the same system allows trainers to manage their budgets more effectively, ensuring that their business operations are both profitable and sustainable.

Strategic Financial Planning

With all financial data consolidated in one system, personal trainers can engage in more effective financial planning.

They can forecast future revenues based on current trends, plan for seasonal fluctuations in client engagement, and set realistic financial goals.

Adopting these strategies can significantly impact the success of any fitness business by ensuring financial health and operational scalability.

Enhanced Client Management

Centralized financial management often includes features that allow personal trainers to manage client accounts more effectively.

This might include tracking session packages, membership renewals, and payment histories.

Having this information readily available makes it easier to manage client relationships, offer personalized promotions, and address any billing concerns promptly.

Satisfied clients are more likely to continue their training, leading to stable and recurring revenue.

Quick Response to Financial Queries

When financial management is centralized, personal trainers can respond quickly to any queries or issues related to billing or payments.

This responsiveness not only improves client satisfaction but also ensures that financial discrepancies are resolved swiftly, maintaining a steady flow of revenue.

Quick resolution of financial issues also helps in maintaining a professional image and trustworthiness among clients.

Simplified Financial Compliance

For personal trainers operating in regions with stringent financial regulations, a centralized financial management system helps in maintaining compliance with tax laws and accounting standards.

It simplifies the process of generating financial reports for tax purposes, audits, or business assessments, reducing the administrative burden and risk of non-compliance penalties.

3. Strong Security Measures

The security aspect of Virtuagym Pay is a critical advantage.

By making sure that payment information is processed securely through a PCI DSS Level 1 Service Provider, personal trainers can build trust with their clients, ensuring that their financial transactions are safe.

This trust can lead to higher client retention and more stable income streams.

Here’s a detailed exploration of how these security features can help personal trainers maximize their revenue:

Enhanced Client Trust and Confidence

One of the most direct impacts of robust security measures is the enhanced trust that clients place in a personal trainer’s services.

When clients know that their sensitive payment information is handled securely, they are more likely to continue their subscriptions and recommend the services to others.

This trust is crucial for maintaining a loyal client base and attracting new clients through positive word-of-mouth.

Prevention of Financial Fraud

Security measures such as encryption, secure payment gateways, and compliance with standards like PCI DSS (Payment Card Industry Data Security Standard) help prevent potential financial fraud.

By safeguarding the system against unauthorized access and data breaches, personal trainers minimize the risk of financial losses and the associated costs of dealing with fraud, such as legal fees, refunds, and damage to reputation.

Stability and Reliability

Security contributes to the overall stability and reliability of the payment processing system.

Personal trainers can conduct their business knowing that the system is less likely to suffer from security breaches or data corruption.

This reliability ensures a smooth operation, where financial transactions are processed without interruptions, ensuring a steady flow of revenue.

Compliance with Legal and Regulatory Requirements

Many regions have strict regulations governing the handling of personal and financial data.

Security measures make sure that personal trainers comply with these legal requirements, avoiding potential fines and legal issues that could arise from non-compliance.

This compliance not only protects the trainer financially but also enhances their reputation as a professional and trustworthy service provider.

Marketability of Security Features

Security can be a significant market differentiator, especially in industries where personal and financial data are involved.

Personal trainers using Virtuagym Pay can promote the security of their payment processing as a key feature of their service, appealing to health-conscious individuals who are equally conscious about their personal data security.

Long-Term Business Sustainability

Robust security measures contribute to the long-term sustainability of a personal training business.

By ensuring that financial and personal data are secure, trainers mitigate risks that could potentially disrupt their business operations and impact their revenue.

This proactive approach to security lays a strong foundation for a stable, reputable business that can grow and adapt in a competitive market.

4. Easy Onboarding and Plug-and-Play Setup

For personal trainers transitioning from other payment systems or starting new ones, Virtuagym Pay offers easy onboarding with a plug-and-play setup that doesn’t disrupt existing operations.

This ease of integration ensures that trainers can get their payment system up and running quickly, minimizing downtime and potential loss of income.

Rapid Deployment and Minimal Downtime

The plug-and-play nature of Virtuagym Pay allows personal trainers to integrate this payment system into their existing operations quickly and without significant downtime.

This swift deployment is crucial for maintaining continuity in business operations, ensuring that there is no disruption to the services offered to clients.

By getting the system up and running quickly, trainers can start benefiting from automated payment processing and other features without loss of revenue due to system transitions.

Reduced Setup Complexity

The ease of onboarding with Virtuagym Pay means that personal trainers do not need extensive technical knowledge to set up and start using the system.

This simplicity reduces the intimidation factor often associated with adopting new technologies and lowers the barrier to entry for trainers who may not be tech-savvy.

It also saves costs on potentially having to hire technical support to implement the system, directly affecting the bottom line positively.

Training and Support

Virtuagym provides specialized 1:1 onboarding support, which includes demon on how to use the system effectively.

This personalized support ensures that personal trainers can maximize the utility of the payment system from day one.

Having access to expert guidance and support helps trainers use the system more efficiently, leading to better management of client transactions and financial data.

Immediate Access to Features

With a plug-and-play setup, personal trainers gain immediate access to all the features of Virtuagym Pay, such as the ones mentioned above.

Such improvements directly contribute to the increase of personal trainer income through higher client retention and reduced operational costs.

Confidence and Professionalism

When personal trainers can seamlessly integrate and utilize an advanced payment system like Virtuagym Pay, it boosts their confidence in managing the financial aspects of their business.

Additionally, offering a professional and technologically advanced payment solution can enhance the trainer’s credibility and professionalism in the eyes of clients, potentially attracting a higher caliber of clientele.

Focus on Core Business Activities

Ultimately, the easy onboarding and plug-and-play nature of Virtuagym Pay allow personal trainers to focus more on their core business activities—training and coaching clients—rather than getting bogged down by the complexities of payment management.

This focus can lead to better service delivery, more satisfied clients, and, consequently, increased revenue.

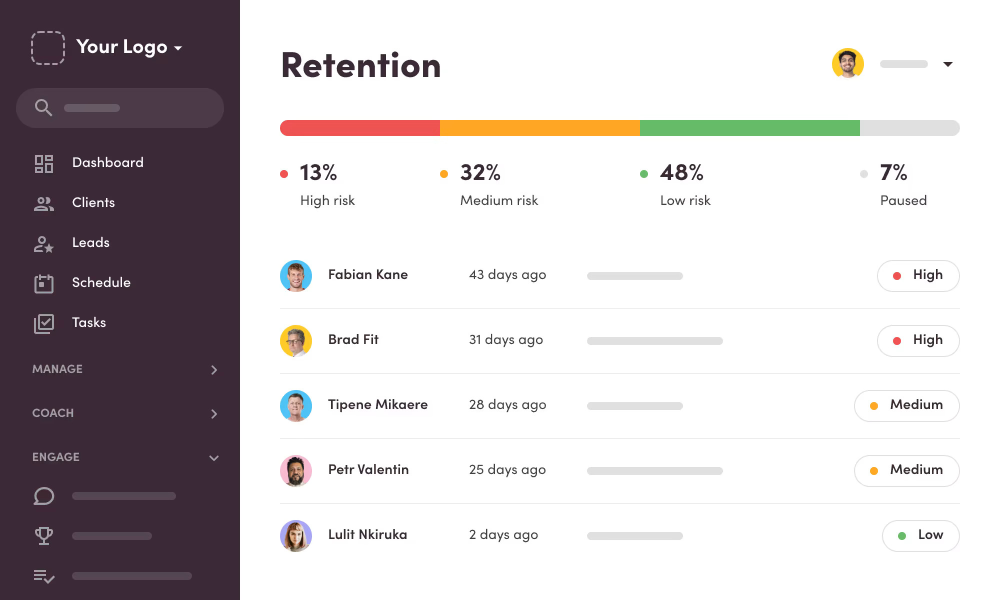

5. Retention Dashboard

Virtuagym Pay’s retention dashboard provides valuable insights into client behaviors, helping trainers identify at-risk clients and implement strategies to retain them.

Personalized offers are especially effective in helping new clients sign up for ongoing training sessions.

Here’s how this tool can be pivotal in boosting the revenue of personal trainers:

Insightful Client Data Analysis

The retention dashboard provides personal trainers with valuable insights into client behaviors and patterns.

This data includes attendance rates, payment histories, and session participation levels.

By analyzing these metrics, trainers can identify trends and potential issues that may affect client satisfaction and retention, such as irregular attendance or delayed payments.

Understanding these patterns allows trainers to proactively address client concerns and tailor their offerings to meet client needs better.

Early Identification of At-Risk Clients

One of the key benefits of the retention dashboard is its ability to help trainers quickly identify clients who may be at risk of discontinuing their services.

Factors such as a drop in session attendance or delays in payment can be early indicators of a client’s declining interest or financial difficulty.

By identifying these signs early, trainers can engage these clients with personalized interventions, such as reaching out to discuss their training program, offering modified payment options, or providing additional motivation and support.

Enhanced Client Engagement Strategies

With the data from the retention dashboard, personal trainers can develop targeted engagement strategies that improve client satisfaction and loyalty.

For example, trainers can create specialized fitness programs or promotions tailored to the interests and behaviors of specific client segments.

Additionally, the professional handling of payments and services impresses potential clients, making them more likely to sign up.

Strategic Decision Making

The retention dashboard enables personal trainers to make informed decisions about their business strategies.

For instance, if the data shows high retention rates for certain types of training sessions or times of day, trainers might decide to increase offerings in those areas.

Conversely, if certain programs have low retention, trainers can evaluate whether to improve these programs or reallocate resources to more successful areas, ensuring optimal use of time and resources for maximum revenue generation.

Improved Client Communication

Effective communication fosters stronger bonds with current clients, encouraging them to continue their fitness journeys with your services.

For example, trainers can send personalized messages or emails acknowledging client milestones, offering health tips, or reminding clients of upcoming sessions.

This enhanced communication helps build stronger relationships, making clients feel valued and more likely to remain engaged with the trainer’s services.

Quantifiable Metrics for Success

The retention dashboard provides quantifiable metrics that trainers can use to measure the success of their retention strategies.

This data-driven approach allows trainers to set specific goals, monitor progress, and make adjustments as needed.

Having concrete metrics also helps in demonstrating the value of their services to potential and existing clients, enhancing trust and credibility.

Boosting Referrals

Satisfied clients are more likely to refer others to their personal trainer.

By using the retention dashboard to maintain high levels of client satisfaction, personal trainers can increase their referral rates, leading to new client acquisition without the associated marketing costs.

This organic growth is a cost-effective way to expand the client base and increase revenue.

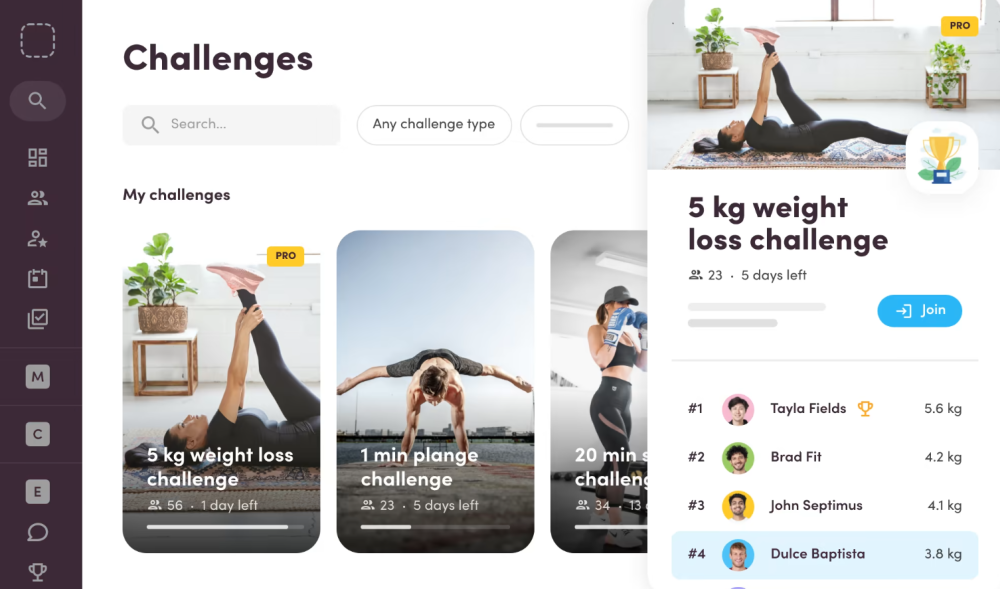

6. Powerful Process Automation

By automating administrative tasks such as scheduling, billing, and client communications, personal trainers can devote more time to their core services.

This efficiency not only improves service quality but also opens up opportunities for trainers to handle more clients or offer additional services like fitness challenges, seminars, or other promotions to attract new clients

Conclusion

Virtuagym Pay can greatly improve how personal trainers handle their business, making things simpler and more efficient.

With features like automated payments and easy tracking of client data, trainers can spend less time on paperwork and more time helping their clients reach their fitness goals.

Ultimately it helps keep financial transactions smooth and secure, which builds trust with clients. This trust, combined with less administrative work, means trainers can focus on growing their business and increasing their earnings. Check out Virtuagym pay now!